Notes and Takeaways from Obviously Awesome

Source: Amazon

When I read it: July 2020

Why I read it: My biggest challenge right now at LegUp Health is figuring out how to explain what LegUp Health is to potential customers. People do not buy what they do not understand. Most businesses (and people) face this challenge at various points in their lives. This book was recommended by a friend and is now my favorite read on positioning. Whether you’re a new startup or recent college graduate attempting to position yourself for the first time, or you’ve evolved and need to revisit your positioning, this book will help you think about your business (or yourself) in a new context. And that context might make it much easier for you to explain what you are to others.

Go to the amazon listing for details and to read or scroll down for my notes.

Want to get my future notes when I publish them? Subscribe to my weekly newsletter below.

My notes

What is positioning

Positioning is “the act of deliberately defining how you are the best at something that a defined market cares a lot about.”

Every single marketing and sales tactic that we use in business today uses positioning as an input and a foundation ⇒ If we fail at positioning, we fail at marketing and sales. If we fail at marketing and sales, the entire business fails.

Many of us know what positioning is, but very few of us understand how to do it.

There are no good books on how to do positioning. Al Ries and Jack Trout defined positioning in 1981 via Positioning: The Battle for Your Mind, but they didn’t tell us how to do it.

Positioning as context

Think of positioning as “context setting” for a product ⇒ good positioning provides the right clues to your potential customers so they have the right context to understand your product (or you; this applies to positioning yourself as well).

Understanding something new is challenging because we don’t yet have a frame of reference ⇒ as humans, when we encounter something new, we attempt to make sense of it ⇒ we do this by taking all the available clues to decide how to think about this new thing.

When customers encounter a product they have never seen before, they look for contextual clues to help them figure out what it is, who it’s for and why they should care ⇒ good positioning gives customers the ability to easily understand what your product is, why it’s special and why it matters to them.

Most businesses leaders do not intentionally position their products ⇒ they assume it is as obvious to their customers as it is to them.

Positioning is not:

A tag line

A point of view

A vision

A brand

Messaging

Marketing or a go-to-market strategy

^ these all flow from positioning, which should happen first.

The components of positioning

Geoffrey Moore gave us the “positioning statement” in Crossing the Chasm:

For (target customer) who (statement of the need or opportunity), the (product name) is a (product category) that (statement of key benefit – that is, compelling reason to buy). Unlike (primary competitive alternative), our product (statement of primary differentiation).

The problem with the positioning statement is that it assumes you know the answers - but, you really don’t ⇒ positioning is the art of answering these blank questions… not writing them down.

While this framework doesn’t help us “do” positioning, it does start breaking down the components of positioning.

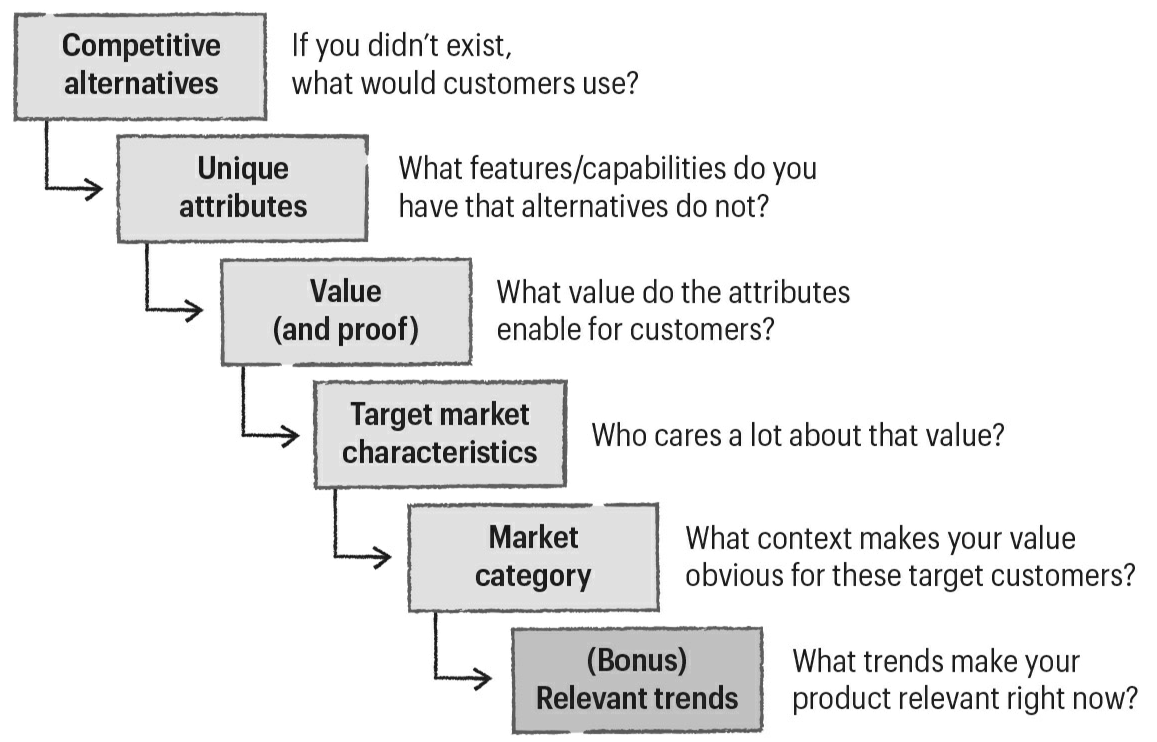

The components of positioning are:

Competitive alternatives. What customers would do if your solution didn’t exist.

A competitive alternative is what your target customers would “use” or “do” if your product didn’t exist (e.g. a competitive solution, hire an intern, use a spreadsheet, do it manually, etc.)

Here you want to understand what your customers compare your solution with ⇒ it’s the baseline for how they will decide whether you are “better”

Unique attributes. The features and capabilities that you have and the alternatives lack.

Think of unique attributes as your “secret sauce ⇒ the things you can do that your competitive alternatives can’t ⇒ the list of capabilities that you have and the alternatives don’t (e.g. technical features, business model, delivery model, specific expertise or experience, etc.)

Here you want to make sure they are different when compared with the capabilities of your competitive alternatives from a customer’s point of view.

Value (and proof). The benefit that those features enable for customers.

This is the benefit you can deliver to customers because of your unique attribute ⇒ it’s the reason why someone should care about your secret sauce ⇒ it should be as fact-based as possible.

Here you want to be able to prove your value in an objective way.

Target market characteristics. The characteristics of a group of buyers that lead them to really care a lot about the value you deliver.

These are the characteristics of customers who care the most about the value your product delivers

Market category. The market you describe yourself as being part of, to help customers understand your value.

This is the “frame of reference” for your target market ⇒ this gives them the context to understand your unique value ⇒ this is one of the most important positioning decisions you will make because the market category you pick creates all kinds of assumptions for potential customers.

Here you want to choose a market category that will make your unique characteristics “obviously awesome”.

Relevant trends. Trends that your target customers understand and/or are interested in that can help make your product more relevant right now.

Trends can help potential customers understand why your offering is something they need to pay attention to now.

Each component of positioning has a relationship to the others

The order in which you define the components is very important. The flow looks something like this:

Source: April Dunford

Positioning a product versus the company

When a company has a single product, positioning the product and the company as the same thing is the easiest path.

When your company has multiple products, you need to think about product positioning and company positioning as separate but linked things.

The 10-step positioning process

Understand the customers who love your product

Form a positioning team

Align your positioning vocabulary and let go of your positioning baggage

List your true competitive alternatives

Isolate your unique attributes or features

Map the attributes or features to value “themes”

Determine who cares a lot about what you are doing

Find a market frame of reference that highlights your strengths and determine how to position it

Layer on a trend (if possible)

Make your positioning shareable

Step 1: Understand the customers who love your product

The first step in the positioning exercise is to make a short list of your best customers ⇒ your best-fit customers hold the key to understanding what your product is.

(If you don’t have any super-happy customers, you’re not ready to focus on positioning. Instead continue to iterate on your business/product idea until you do. The Mom Test is a good framework for idea validation / this stage. In the meantime, keep your mind open to how you might position your business/product in the future.)

Step 2: Form a positioning team

This process works best when it’s a team effort, ideally from across different functions within the company ⇒ This team can expose how different groups in your company hold certain assumptions about your attributes, value and target markets.

The person responsible for the business of the product must be in the room and drive the positioning effort ⇒ for most companies, this means the CEO/founders.

Positioning is a business strategy exercise ⇒ it impacts every group in the organization.

Step 3: Align your positioning vocabulary and let go of your positioning baggage

Regarding vocabulary, make sure the team is aligned on:

What positioning is and why it matters

The components of positioning and how we define each of those

How market maturity and competitive landscape impact the style of positioning you choose for a product

Positioning baggage = your long held beliefs about how your product should be positioned” ⇒ it’s important to let go of these beliefs ⇒ the team needs to be open to a new way

Step 4: List your true competitive alternatives

“The features of our product and the value they provide are only unique, interesting and valuable when a customer perceives them in relation to alternatives.”

You need to understand who your real competitors are in the minds of your customers ⇒ Understand what a customer might replace you with.

Ask yourself: “what would our best customers do if we didn’t exist?” ⇒ the answer might surprise you (it could even be “do nothing”).

Once you have a list, rank the competitive alternatives from most common to least common and focus on the most common ones ⇒ Ask yourself: “what would the majority of your best customers really do?”

Finally, group the alternatives into 2-5 macro groups.

Step 5: Isolate your unique attributes or features

During this step, the goal is to identify where you are different (and better) than the competitive alternatives ⇒ list every unique attribute and feature you can think of.

Stay focused on your features (i.e. something your product or company has or does and attributes (i.e. your capabilities). These could be:

Proprietary processes

Expertise in a special area

Distribution channels

Partnerships

Special skills

Experience with a niche

Also, stay focused on the ones that drive a potential benefit (i.e. they should be provable) ⇒ third party validation (including quotes from customers) count as proof.

Finally, focus on the ones that customers care about when they are evaluating your product during a purchase.

Step 6: Map the attributes or features to value “themes”

Customers care about what your features can do for them (not the features themselves).

Features enable Benefits which lead to Value:

Feature = Something your product does or has

Benefit = What the feature enables for a customer

Value = How the benefit contributes to a goal the customer is trying to achieve

Making these connections requires you to dig:

To derive the benefits, ask yourself: What does this feature get our customer?

To derive the value, ask yourself: What does this benefit enable our customer to do? What can they do now that they have this that they couldn’t do before?

Once you have mapped the values, group the value into themes ⇒ Ask yourself: “What points would naturally be related in the minds of your customers and prospects?”

You might end with one value “theme” ⇒ This is OK because it will focus on what makes your product special and unique.

Step 7: Determine who cares a lot about what you are doing

Marketers call this step a “segmentation” exercise.

Good segmentation captures a list of a person’s or company’s easily identifiable characteristics that cause them care about what you do.

In general, a segment needs to meet at least these two criteria to be worthy of focus:

It needs to be big enough that it’s possible to meet the goals of your business, and

It needs to have important, specific, unmet needs that are common to the segment.

You should segment as narrowly as you can ⇒ you only need a large enough segment to meet your near-term growth goal

Don’t worry whether the segment is big enough for the long term ⇒ you can revisit it later and broaden it.

For consumers, characteristics could include:

Combinations of things such as other brands they own or like

Stores they buy from

Their job

Their music or entertainment preferences

For businesses, characteristics could include:

The way they sell

Other products they purchased

Skills they or don’t have at their company

Step 8: Find a market frame of reference that highlights your strengths and determine how position it

Here, you pick a market category (i.e. frame of reference) that makes your value obvious to the segment who cares most about it ⇒ It’s like giving a customer the answer to the question: “what are you?”

The market category we choose should trigger a set of assumptions (re: competitors, features, etc.) that work to our advantage ⇒ This should make it easy for potential customers to compare us to what they already know and quickly figure out what we do and how we are different.

At a high level, we can either choose to enter an existing market or create a new market.

Three ways to do this:

Use abductive reasoning ⇒ when you look at your unique features and value, ask yourself what categories of products typically have these features?

Examine adjacent markets ⇒ if you’ve previously positioned yourself in a market category, look at categories adjacent to it (especially the ones that are growing).

Ask your customers ⇒ Be careful seeking feedback from customers as they aren’t positioning experts (they will typically state the obvious category, which might not the best one)

There are three core strategies for positioning within a market segment:

Head-to-Head ⇒ Position to win an existing market.

Here, you take on an existing market leader (if there is one) head to head and try to beat them and the existing players at their own game.

Potential customers are well educated about what solutions in this market can and cannot do and understand the purchase criteria (i.e. what is important to consider when making a purchase and what is not) ⇒ in other words, they’re educated buyers.

With head-to-head, you’re claiming to be better for most, if not all, customers (not just a subsegment)

Use this style when:

When you are already a leader in the market,

There is no market leader established yet, or

A market shift has created an opportunity to take on an established leader (if you have the resources)

To use this style, you need to:

Determine whether or not the category has been created in the minds of enough customers to meet your business goals.

Determine whether you can redefine the purchase criteria to your advantage.

Determine whether you can move quickly enough to become the leader (this often requires venture capital and may not be suitable for bootstrappers.)

Be prepared to compete with multiple competitors who will be simultaneously trying to prove they are better than you

Big Fish, Small Pond ⇒ Position to win a subsegment of an existing market.

Here, you avoid competing head to head by targeting a subsegment that is under- or un-served by existing players ⇒ you break the market into pieces and choose a piece you can win.

With big fish, small pond, you’re claiming to be better for a subsegment of customers (not for most, if not all)

Once you win your subsegment, you can expand from there until you are big enough (and ready) to take on the market leader.

Use this style when:

The market category is well defined (If the category is not well understood, subsegmenting it is only going to result in further market confusion.)

There’s a clear market leader (and you’re not it)

There is a clearly definable group of customers with unique needs that are not addressed by the market leader

You are able to meet the unmet needs of the segment much better than the market category leader

To use this style, you need to:

Be careful that the market leader doesn’t turn their attention to the subsegment and beat you with a “good enough” solution (ideally your competitive advantage in this segment is hard for the market leader to copy)

Create a New Game ⇒ Position to win a market you create.

Here you create a new market category in which you position yourself as the leader.

This positioning approach usually is only possible when there is a massive paradigm shift in the market (due to new technology, economic changes, policy forces, etc.)

This is the hardest positioning approach ⇒ With this approach, you have to create demand (i.e. You have to sell the category AND your product).

Use this style only when:

You have evaluated every other possible existing market category and you cannot position your offering head-to-head or as a big fish, small pond.

To use this style, you need to:

Explain why the category deserves to exist ⇒ answer the question, “why now?”

Create a product that is new and different from what exists in other market categories ⇒ this requires shifting the way your customers think

Sell the category first, and then position your product as the leader

Raise enough capital to have the resources to both build the category and protect it from new entrants (Note: this approach also requires patient investors with deep pockets)

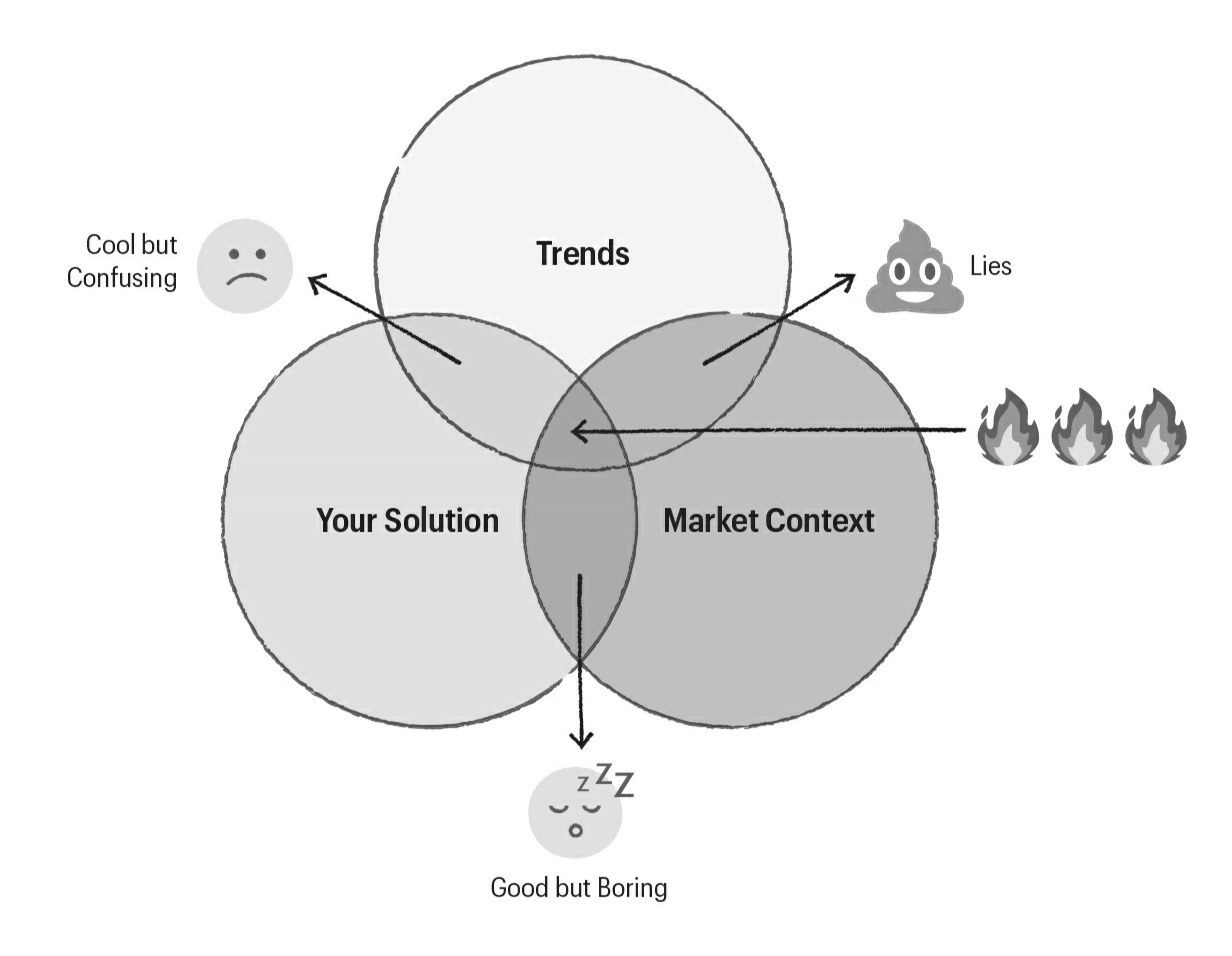

Step 9: Layer on a trend (if possible)

This step is optional but potentially really powerful if you get it right ⇒ but if you get it wrong, it just adds confusion ⇒ Be careful with trends ⇒ overemphasizing trends can confuse buyers and make them wonder what you actually do.

If a current trend helps reinforce your positioning and the value that your offerings deliver, you can use it to make your offering look current and relevant ⇒ trends can give “boring” products pizazz

NOTE: If the trend doesn’t reinforce your positioning, it will create confusion, which is bad ⇒ It’s better to be boring than confusing.

Source: Obviously Awesome

Step 10: Make your positioning shareable

Once you complete your positioning, the next step is to make it available to your organization so it can inform all that you do ⇒ So, document it.

One way to document is to use April’s “positioning canvas”:

Source: April Dunford

How to implement your new positioning

Once you have your positioning documented, it’s time to implement it.A great place to start is to develop a sales story that supports the positioning and use that to develop new messaging ⇒ The sales story works because it requires everyone to agree on how the positioning translates into a “pitch.”

Creating a sales story

A sales story generally has the following arc:

It starts with a definition of the problem that your solution was designed to solve.

The story then moves to describing how customers are attempting to solve the problem today and where the current solutions fall short.

The next stage of the story is what April calls “the perfect world.” It’s where you describe what the features of a perfect solution would be, knowing what you know about the problem and the limitations of current solutions.

The sales story goes on to introduce the product or company and position it in the relevant market category.

Next, the story naturally flows into talking about each of the value themes with a bit more detail into how the solution enables that value.

A completed sales deck also adds some information, such as handling common objections, a case study or list of current customers.

The story wraps up with a discussion of whatever you would like the prospect to do next.

Once the story arc is complete, the marketing team will translate it into messaging that can be used across the organization ⇒ Remember to document the messaging in a messaging document for easy reference, along with the positioning.

Positioning is never done - track it over time

Products and markets change over time.

You need to revisit positioning every six months or whenever something changes with your market including:

A new competitor entering

A shift in customer perception or evaluation

A change in government regulations or economic climate

New technology that impacts your market

Random quotes

“How do you beat Bobby Fischer? You play him at any game but chess. I try to stay in games where I have an edge.” - Warren Buffet

“Strategy is about making choices, trade-offs; it's about deliberately choosing to be different.” - Michael Porter

“Find out who you are and do it on purpose.” - Dolly Parton

"You can’t be everything to everyone, but you can be something great for someone." - Matt Cheuvront (this quote wasn’t in the book, but I like this quote better than the similar quote that was in the book)

“There is one thing stronger than all the armies in the world, and that is an Idea whose time has come.” - Victor Hugo

“It's no use of talking unless people understand what you say.” - Zora Neale Hurston

“The future isn’t a place we are going to go, it’s a place we get to create.” - Nancy Duarte

“If you change the way you look at things, the things you look at change.” Wayne Dyer